Campaign for Michigan Film Tax Credit

A message from Lindsey Katerberg, IATSE Local 26 First Vice President:

IATSE Local 26 West Michigan Stagehands ask for your support in our campaign for film tax credits in Michigan. Film tax credits will bring numerous forms of media to Michigan; films, streaming, television, corporate, commercial, as well as benefit and grow existing Michigan businesses, create new Michigan vendors, and most importantly create thousands of new jobs. For those of us in the live events and entertainment industry these tax credits are vital to securing new employment projects and opportunities in these uncharted times where the vast majority has not seen work in our industry since March 2020.

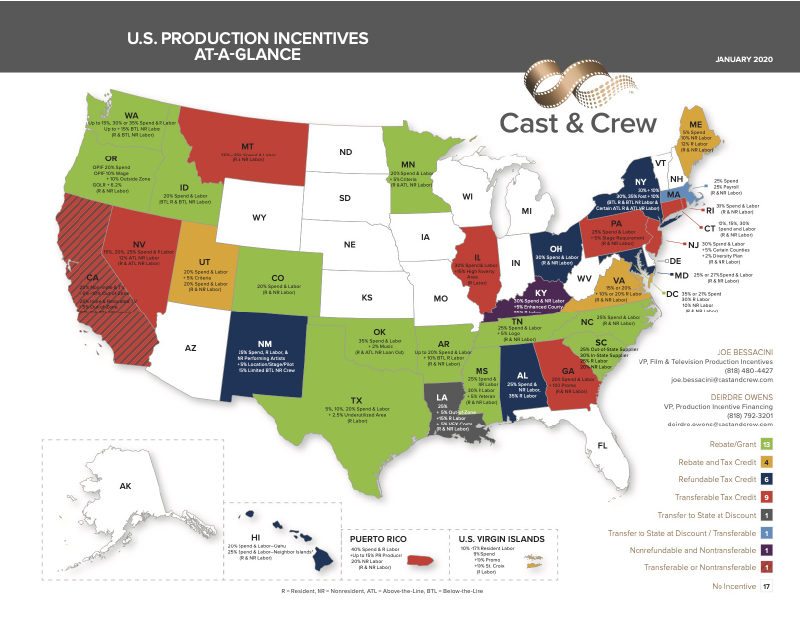

We are seeking discussion with representatives to educate and explain the nature of our industry, the breakdown of this proposed legislation, the multiple ways in which it benefits our State as a whole, and how it brings Michigan to the competitive market with over 30 other states. As we listen to those saying that these tax credits are not a priority given the pandemic and economic challenges, let us remind everyone that our industry has not yet reopened and will not any time soon, leaving us most deeply impacted. In our fight to move forward out of these dark times we have joined the Michigan Film Industry Association in their efforts to rebuild our industry cementing a more secure future for our prospective employment for years to come.

We are working with the Michigan Film Industry Association to create and support a sustainable film tax credit program.

The legislation includes the following:

- A two-tiered program that covers both commercials/industrials & feature film/television/streaming productions

- A transferable tax credit-based system rather than a grant or rebate based one; no money is paid out of the general fund

- Applicants may sell off unused tax credits to other MI based companies, typically at a percentage on the dollar which makes them attractive to purchase. The tax credit stays in Michigan & benefits Michigan companies. It is a one-time transfer with up to 10 assignees

- For projects 20 minutes or longer the application fee is $2000, requires a minimum spend of $300,000, & the cap for total credits issued per year increases at regular 3-year intervals over a 10-year period: $50 million $75 million $100 million

- For projects 20 minutes or under the application fee is $1000, requires a minimum spend of $50,000, & the cap for total credits issued per year increases at regular 3-year intervals over a 10-year period: $2 million $4 million $10 million

- If the cap for credits is not met they roll over into the next year

- The application fee is non-refundable & will be used to fund the Michigan Film Office

- To qualify production must begin within 90 days of approval

- The base tax credit starts at 25% for in state spending with an additional 5% rewarded for the inclusion of a “Filmed in Michigan” logo

- A 30% tax credit is awarded for hiring Michigan residents, non-residents are only given a 20% tax credit, & any wages paid out to a single person per project in excess of $500,000 do not qualify for a tax credit

- The bill includes language defining what constitutes a “full-time employee” which will support a more accurate count when tracking the increase of jobs created as a result of the film tax credits

- Pre-production, production, & post-production will qualify, ‘development’ costs will not

- Language that excludes ‘pass-through’ transactions & businesses from qualifying protect Michigan based companies & encourages new business investment; qualified vendors must show a brick & mortar /inventory/full time employee presence

- Under a tax credit-based system there is less initial burden on the Film Office & Treasury which allows applications to be processed faster- qualified expenditures are verified at the end of the project before a credit amount is issued

- Language that requires verification by an independent CPA & signed affidavit to submit qualified expenditures for approval ensures accountability

- No tax credits will be authorized or issued to any applicant until there is confirmation that all qualified vendor & employee invoices have been fully satisfied & paid in full which ensures that the Treasury can collect taxes before issuing the credit

We encourage you to reach out to your state representatives to encourage their support.