Health Insurance 101: Part Two

In this installment, we’re going to concentrate on who you should call for what kind of help. Your health insurance company is an invaluable resource, but they can’t help you with everything. Knowing when to call them, when to call the National Benefit Fund, and when to call your doctor will save everyone time and frustration.

Things you should call your health insurance company about:

- Questions on medical benefits

- Questions about claims

- If you acquire another health insurance policy that will be primary to the one you have through the IA

- Whether or not a certain procedure is covered (always get a procedure code from your doctor!)

- Whether or not a prior authorization has been received and/or approved for a procedure such as an MRI

- If a certain provider is participating in network

- If you receive an Explanation of Benefits for a medical procedure you do not remember having

Things you should call the National Benefit Fund about:

- Adding/deleting someone to or from your policy

- Questions about premium payments or to make a premium payment

- What benefits are offered and how much they will cost you

- When you become eligible for health insurance

- When you are allowed to make changes to your policy

Things you should call your doctor (or a hospital) about:

- Anything to do with medical billing, paying medical bills, or making payment arrangements

- Why certain tests were ordered or performed

- If you need refills on your medications

- Making appointments for medical services

It’s important to know that your insurance company has no way to see how much if anything you have paid toward a medical bill. All they can see is what your responsibility as a member will be for any given claim. When you receive an Explanation of Benefits from your insurance company, it is not a bill. It is simply a statement detailing how much the provider charges without insurance, how much the negotiated discount for those who do have insurance is, how much (if anything) the insurance company paid the provider, and how much (if anything) you as the patient are responsible for paying.

For example: You see your doctor because you hit your thumb with a hammer. The doctor charges $200 for that office visit if you don’t have insurance. Because you do have insurance, the negotiated rate (which the doctor is required to accept as payment in full) is $150. Under your policy, you have a deductible and coinsurance as we discussed in the first installment of this series. Let’s say you’ve met your deductible already, so you’re paying 20% coinsurance. You are responsible for paying the doctor 20% of $150, or $30. The insurance company pays the remaining $120 to the doctor.

If you paid the doctor $30 at the time of the office visit, your insurance company does not know that. So you will receive an EOB stating your member liability is $30. Since you already paid that, great! File the EOB and go on with your life. But if you paid nothing at the time of service, this is your heads up you will be receiving a bill from the doctor soon.

If you are going to call your insurance company about a claim you see on an EOB, make sure you know the date of service! The statement date on the EOB is sort of helpful, but the customer service representative on the phone must look up claims by date of service. The first page of your EOB is a summary. The following pages are details of each claim that has processed since your last statement. Go to those details for the information your insurance company needs to help you.

You should also be aware that providers may bill you on a monthly basis, but they submit claims to the insurance company by date of service for the most part. So you may be looking at a bill that says you owe $174.38, but your insurance company has three claims for three different dates of service that together add up to that total amount. They also cannot see the bill you were sent, as that is purely between you and your provider.

The I.A.T.S.E. National Benefit Funds are the organization that oversees your health insurance policy among other things. They are who put together the packages from which you may choose your level of coverage. They are who informs the insurance company what package you’ve chosen and how many people are on your policy along with their personal information. They are who you must contact to change your address, to add a new person to your policy, to remove a person from your policy, and to pay your insurance premium.

Anything to do with your policy itself must be addressed with the NBF. There is a link to their website at the bottom of every page of this website.

Each of our employers pay a percentage on top of your gross wages into the Benefit Funds according to their collective bargaining agreement, or in the case of those who use an outside payroll company such as UTP, the payroll company contributes through its agreement with the Funds. When it comes time to pay your quarterly premium, the NBF sends you a statement detailing how much money has been contributed on your behalf and how much (if any) you will need to pay for the premium cost at your chosen level of insurance coverage.

Your insurance company itself has nothing whatsoever to do with what benefit packages are available to you, how much they cost, or what is covered under them. Think of it like this: When you go grocery shopping for your family, the grocery store offers a wide variety of options. You choose food for your family from what is available, pay the price the store charges, and feed your family. It’s up to you if you charge anyone for that food or not, or how much you will charge. Same thing when the NBF (or any employer) shops at the insurance company.

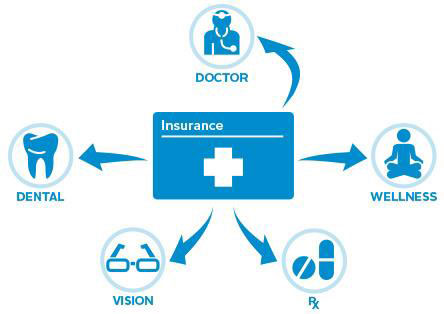

One last thing for this installment… coverage options.

National Health Care Reform says all health insurance policies offered by employers must have a basic minimum level of coverage. Anything more than that is up to the employer (in our case, the NBF) to offer and decide how much it will cost. A basic health insurance policy will have professional (doctors) and facility (hospitals). From there, pharmacy (prescription), dental, vision, hearing, and a variety of other options can be added, most often at additional cost.

Some employers choose to have all forms of coverage through a single insurance company. Others choose different companies for different types of insurance. And even if a health insurance company handles all the types of insurance on your policy, they often have benefit managers for specific items.

For example, with our policies. Empire Blue Cross Blue Shield carries our professional and facility insurance. CVS/Caremark has our pharmacy coverage. I’m a little fuzzy on the names for our vision and dental coverage because I never had them, but I know they are through other companies as well.

Where I have my current insurance, my professional, facility, pharmacy, dental, and vision insurance are all covered under the same insurance company’s umbrella and I use the same card for each of them, but there are benefit managers for the different types. So while my prescription coverage is through my health insurance (Company A) the actual benefit is managed by Company B. Likewise my dental is managed by Company C, and my vision by Company D. If your employer, as the NBF has, chooses to use different insurance companies for the various types, you may have several different insurance cards (for example, the CVS/Caremark card for prescriptions).

It can be confusing, but the good news is if you’re not sure who exactly has your coverage for a certain category you can call the NBF to find out. Your health insurance company may or may not know, so it’s best to check with the NBF to save time and phone calls.